Real Estate advice

I am asked to repeat this advice (and how I did it) way too often. So:Updated 3 years ago

Why Stratas Suck:

- Strata Council fees.

- Possibility of Massive Special Assessments.

- Having to hire professionals for Repairs.

- Even if your unit is fine, you pay for repairs.

- Paying for things you don't use (Elevators, Pool).

- Very Poor Voter Turnout at Council Meetings.

- Restrictive Rules (Pets, Curtains, Noise, Modifications).

Why Stratas Are Good:

- Cheaper Purchase Price.

- Often a more Central Location.

- Great for Second Homes, or Travelers.

- Shared Expenses.

- Common grounds and cleaned and maintained by hired professionals.

- Strata fees may include: Insurance, Garbage, Recycling, Water, Gas.

- Contingency fund can pay for larger items (roofs/windows etc).

My Strategy:

My simple plan to allow anyone to own a house for only slightly more than their current rent.

The Basics:

- (See Mortgage Rules Below)

- Save up $10k. (It is easier the younger you are)

- Buy a "shit-hole" condo in a great building. ~$180k

- Very few people want fix-r-upper condos. They are so cheap.

- Fix up and sell. Should make 50k.

- Repeat 3 times once a year. Use your 150k to buy a $399k house. Fix up and rent out.

- Cheaper Rent forever (with tenants+roommates)

What to look for in a Fixer-Upper:

- If a Condo, Finding a Good building is key.

- If a House, Finding a large building with "Good Bones" is key.

- Focus on finding Estate-sales, Former Grow-Ops, nightmare tenants, etc.

- Find a place that has already had remediation/upgrade work done.

- Don't overdo it on the renos.

- Many of the cheapest places were NOT on M.L.S. They were Private Sales.

- Ask Many Realtors & Friends looking for "hilariously dilapidated condos, that show poorly" but are within your budget and abilities to repair easily.

Property Assessment and Taxes:

- 2017 $546,100.Land $476,000.Buildings$70,100

- 2016 $460,700.Land $396,000.Buildings$64,700

- Tax Rate: 5.46263. Property Taxes: $2982.59. Home Owner Grant: $570

Duplex Terminology:

I get confused all the time by this

- A "revenue duplex" is the whole house (left + right).

- Just a "duplex" is just half.

How to afford a condo on $22/hour:

$22/hour = $45,760/year -15% federal -5% provincial =$36,608. Which Qualifies for a $349K mortgage.Save up $15K for downpayment by saving $15/day for 2.5 years.

(A)Buy 2 bed condo for: $239K. Mortgage $930/month, or

(B)Spend your max:$349K. Mortgage $1449/month.

Finally, get roommate for $800. You pay (A)$130/month or (B)$549/month.

Now, your mortgage costs you $4 a day.

Or better yet, put down an extra $800-$251/month and pay off your condo in 13 years. (That is just matching what your roommate pays).

Slightly-shittier life now, much easier later:

There are many much cheaper places.I have always said if I was forced to rent, I would rent the ground floor unit #1@1179 Esquimalt Rd.

I had many friends lived there in the last 20 years. It is small, but very doable for the short term.

It used to be $110 /month in 2001.

In 2019 is was still $380/month.

With that, I could save 70% of my ($2542/month gross) wages, and have the $8900 down payment needed for the $178K bachelor condo @ 647 Michigan St. in 4-5 months.

And your mortgage would only be $724/month @2.25% interest.

Yes, Kids, previous debts etc may complicate things, but they ONLY increase the timeline, not the possibility.

https://www.realtor.ca/real-estate/22487538/808-647-michigan-st-victoria-james-bay

Many dirt-cheap rental places out there:

- Storage lockers,

- Garages,

- Short-term leases,

- Sublets,

- House undergoing renovations,

- Vacant building that let you live there FREE to provide security,

- Units you paint, clean, floor, etc for FREE rent,

- Perfectly-fine places that are being condemned (eg. Danbrook One @2766 Claude Rd $400/month),

- Hong-kong-sized rooms (eg. @ 1020 Pembroke street for $300/month)

How to Afford a $900k House:

- $45k Downpayment (5%)

- Borrowing $855k for 25 years @2.14% is $3,678.53 / Month

- Qualify with a combined pre-tax income would have to be $9,196.32 / mo ($110,356/yr)

- Garages

- Garages

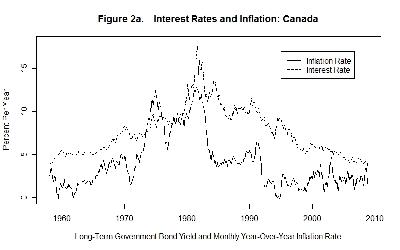

Mortgage Rules, Totally Over-Simplified:

Updated 2018

- Current Interest Rates are around (3%)

- But you must pass "Stress Test": Qualify at Higher Interest Rate (5%)

- Minimum Down Payment is 5%.

- Example: $10k Down, on $200K Condo, for 25 years==$903/month.

Personally:

I am living proof this works. I wasn't lucky. I wasn't smart. I just followed a very simple plan. I have NEVER paid rent. (Moved right from my parents into condo at age 23)

Math Tools::

Smarter to Buy or Rent:

But was it smarter to Rent or Buy, Now vs Then1962: $ 110 x 12 = Rent. Or $12.5K = 9.5 Years

2017: $2500 x 12 = Rent. Or $700K = 23 Years

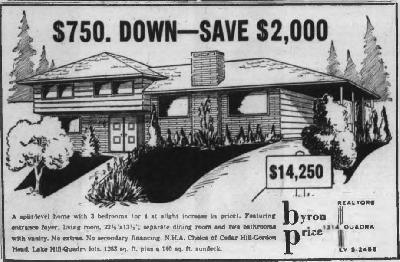

For Perspective before Complaining:

People love to share this pic as their excuse to why they can't afford a house, and how earlier generations wrecked the market.

- Thats $116,493.75 in 2018 Dollars

- At only 3% interest for 56 years, it would be have grown to $623,744.68

- So considering a very-safe Government Bond rate (Average 6.8%), it was not a good investment, EXCEPT you got to live in it.

My Next Steps:

I never had as much fun in my life, as when built this home. I

- Was In the best (physical) shape of my life,

- Slept Well

- Worked every single day 8-14 hours,

- Friends were always over to visit or help,

I now have:

- Industry Connections

- Construction Experience

- Nearly every tool.

- A place to live.

- A (large) amount of equity.

- The time to build it right

I really want / need to do it again. So my options are:

- Build a "Garden House" ($50K) in the back yard.

But I have to wait till at least 2019 for the new laws. - Buy a DESTROYED Condo ($190K), fix it up for $8k - $10k, rent it out, then sell, and repeat.

Can I qualify for another mortgage, or cash out equity? - Sell My House, and Buy John's Beautiful(yet destroyed) Cabin in Duncan. ($320K, 16 acres).

The commute would be a huge problem for me, even though I work at home. - Sell My House, and Buy a piece of land in town, and build a house from scratch.

Would require my house to sell for $760K+, and have a possiblility of finding a replacement property for no more than $450k.

Not the Right Time:

For 16 years. I've been told by so many:I am so glad I didn't listen!

I am so glad I got my condo at age 22. And paid off my HOUSE at 37. You can do it too.

Videos:

Should you buy a House

Cabin idea Notes:

- One acre of Grass = 100 bails of hay==4500lbs==$450 = enough for 4.8 goats or 2.8 sheep.